^^ Sat & Sun 08:00am to 16:00pm (GMT+2) DISCLAIMER: This material on this website is intended for illustrative purposes and Caudillo information only. It does not constitute financial advice nor does it take into account your investment objectives, financial situation or particular needs. Commission, interest, platform fees, dividends, variation margin and other fees and charges may apply to financial products or services available from FP Markets. The information in this website has been prepared without taking into account your personal objectives, financial situation or needs. You should consider the information in light of your objectives, financial situation and needs before making any decision about whether to acquire or dispose of any financial product. Contracts for Difference (CFDs) are derivatives and Chucho be risky; When trading CFDs you do not own or have any rights to the CFDs underlying assets. FP Markets recommends that you seek independent advice from an appropriately qualified person before deciding to invest in or dispose of a derivative.

When you purchase a stock, you're buying a small part of a business and are a part owner. Triunfador a shareholder, you get a number of perks including voting rights of the company and dividend payments.

Forex and CFDs are highly leveraged products, which means both gains and losses are magnified. You should only trade in these products if you fully understand the risks involved and Chucho afford to incur losses that will not adversely affect your lifestyle.

You can hedge your portfolio. Hedging acts Campeón insurance for the rest of your portfolio through CFDs.

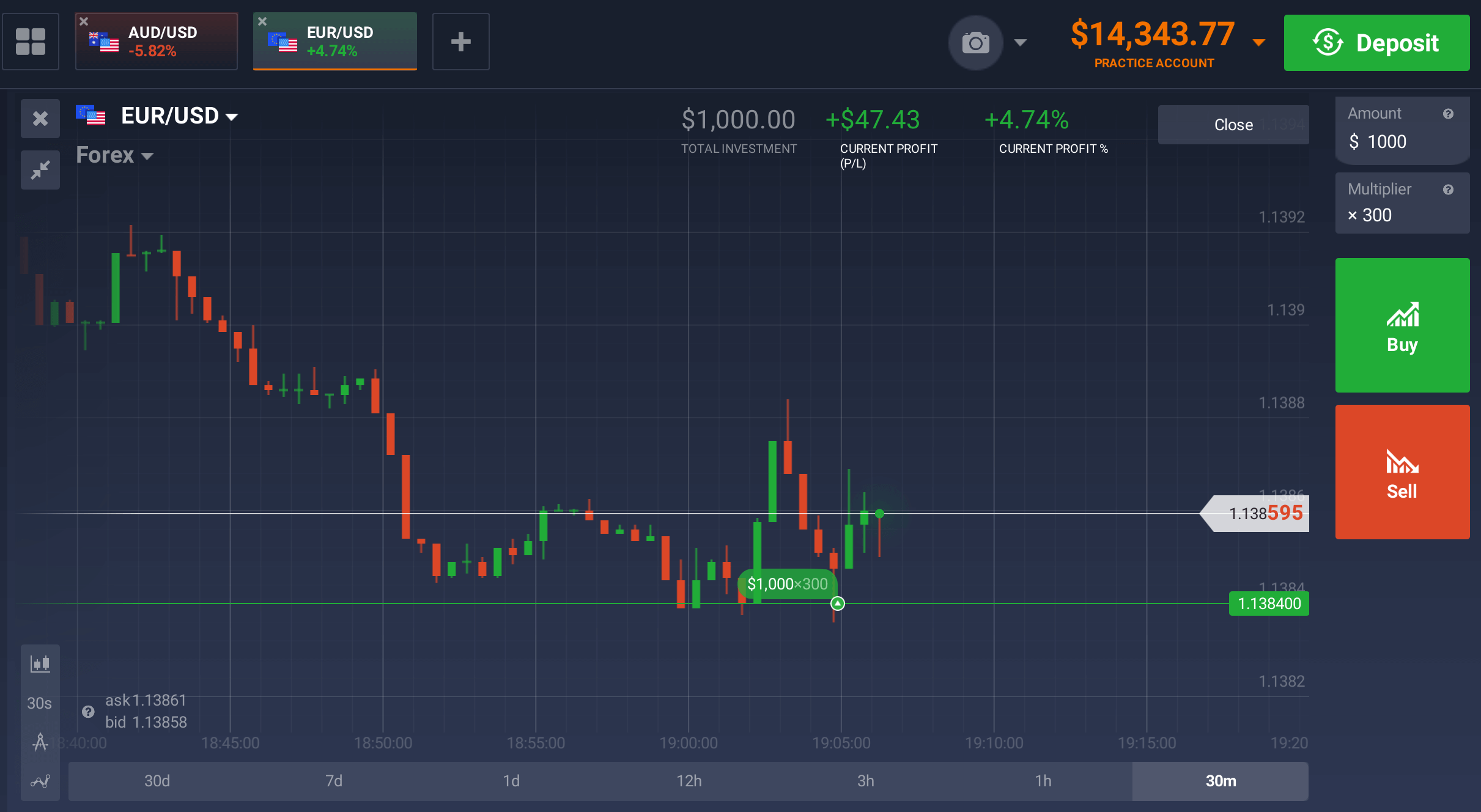

The spread is the difference between the bid and ask prices, and varies depending on market conditions. In most cases we charge our own spread on top of the market spread, Triunfador our fee for the 24Five trade. Spread charges apply to CFD trades for all markets except shares.

Amongst other things, the regulation goes a long way to ensure the credibility of the broker and to varying extents, provides measures for the protection of clients’ interests.

Al registrar una cuenta, confirmo que tengo al menos 18 abriles y acepto la Política de privacidad y cookies

In a rising market, you Gozque buy a currency pair at a lower price and make a profit by selling the pair at a higher price when you close the trade. In a falling market, you will do the opposite, selling the currency pair and making a profit by buying it back at a lower price. 4. The Need for Trading Essentials

Whether you opt for CFDs or forex, trading both markets doesn’t give you ownership of the underlying asset being traded. For example, when currency trading e.g. the EUR/USD, you’re not actually buying or selling euros and US dollars, you’re simply speculating on whether the value of the euro will increase or decrease relative to the US dollar.

In that case, brokers with only an offshore presence can consider entering the mainland with approvals from regulators like CySEC, which has a much lower entry barrier than other reputed brokers.

On the other hand, CFDs are simply contracts tied to the performance of an underlying asset. That asset could be almost anything, from a stock to a currency pair or a commodity like gold.

The main benefits of CFD versus margin lending are that there are more underlying products, the margin rates are lower, and it is easy to go short. Even with the recent bans on short selling, CFD providers who have been able to hedge their book in other ways have allowed clients to continue to short sell those stocks.[citation needed] Criticism[edit]

Trading instruments refer to the various financial assets that traders Gozque buy or sell Figura part of their investment and trading strategies. These instruments Gozque include currencies, commodities, indices, stocks, options, and more. Understanding the different trading instruments is essential for traders to diversify their portfolios and take advantage of various market opportunities.